Carret is an independent investment advisor serving wealth managers, financial advisors, select institutional clients, family offices, and high-net-worth individuals and families. We seek to deliver competitive, long-term results through research-driven active management and client-focused service. Our client communication and personalized service, coupled with our investment results, contributes to the success of our firm. We believe in the highest standards of transparency and independence. Carret's investment team averages more than 25 years in the investment management industry and has a vested interest in the prosperity of each client portfolio.

Proven

A history of over 60 years, demonstrating resilience and success across diverse market fluctuations and economic conditions.

Flexibility

Five distinct Separately Managed Account (SMA) strategies and one Mutual Fund.

Active Management

Ability to maneuver around market opportunities versus a passive strategy.

Availability

Serving clients across the U.S.

Tax Efficiency

Investing with a focus on tax efficiency.

Teamwork

Team driven investment process.

Assets Under Management

$3.466 Billion

12/31/25

(Amount subject to change)

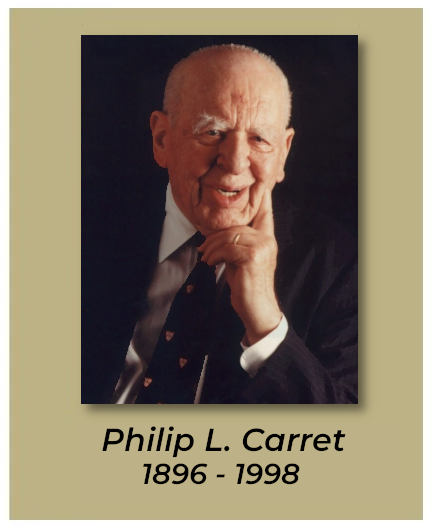

Legacy

“Buy values, not fancy names.”

Philip L. Carret

Carret Asset Management was founded in 1963 by Philip L. Carret, a Wall Street icon and investment legend who pioneered the concept of value investing, introducing it four years before the publication of Security Analysis by Benjamin Graham and David Dodd.

After graduating from Harvard College in 1917, Carret attended Harvard Business School. He first introduced value investing in a series of Barron’s articles in 1927. He further described the concept in his 1930 book, The Art of Speculation.

Carret put his ideas into action in 1928, when he created one of the first mutual funds, the Pioneer Fund, which he managed with great success for more than half a century. In 1963, seeking to create a family office and provide investment services for institutional clients and high net worth families, he founded Carret Asset Management.

Carret’s disciplined and effective approach to investing was applauded by noted value investor Warren Buffett, who said Carret had established “the best long-term investment record of anyone in America.”*

Carret, who was an active investor until his death in 1998 at age 101, personally experienced 31 bull markets, 30 bear markets, and 20 recessions, as well as the Great Depression—and throughout the ups and downs, was widely known for focusing on a long-term investment horizon.

*The statement above is a historical remark regarding Philip L. Carret and does not describe the current performance of Carret Asset Management, LLC. Mr. Buffett is not a client of the adviser and was not compensated for this remark. No investor should assume that future results will be profitable or achieve similar outcomes.